Tick Chart Viewer displays charting data for stocks. Various chart types can be configured including HLOC (high/low/open/close), Candle Stick, Closing, Median, and Typical prices, and Weighted closing.

Configuration consists of beginning and end dates. Real-time charting can be configured as well as the time period for reporting trades. Tick Chart Viewer's optional bar graph can be setup to display data in increments from one minute to one day.

New orders can be placed and canceled and other WTP applets can be opened via the Action menu.

From the WTP Toolbar, select Analyze then Tick Chart Viewer.

Alternate Method:

From the WTP menu select Tick Chart Viewer.

Select the charting date range in Tick Chart Viewer by one of two methods:

From

the drop-down list of preset dates

Manually entering the date range

Press the radio button next to the drop-down list select one of the following:

Today

Week

Month

3 Month

Year

YTD (year to date)

To manually enter the from/to dates, press the radio button next to From and type in the date range or select the dates from the drop-down list.

The horizontal axis in Tick Chart Viewer reflects incrementally the selection made in the Bar Size drop-down list. Select one of the following:

1 Minute

5 Minutes

10 Minutes

1 Hour

6 Hours

1 Day

Press the Refresh Button as often as desired to repaint Tick Chart Viewer data.

Tip: It might be beneficial to lower the Bar Size reporting times to avoid continued use of the Refresh button.

The zoom function is located on the lower left corner of Tick Chart Viewer. To zoom in on the chart, press the + key. A zoom tool in the shape of a magnifying glass will appear in the chart. Repeated pressing of the tool brings up a higher level of magnification. When zooming in on a chart, horizontal scrolling is enabled.

Pressing the — zoom key results in the "zoom out" tool being displayed in Tick Chart Viewer. Repeated pressing of this tool causes the chart to reverse its previous zoom level, eventually resulting in the original non-zoom display.

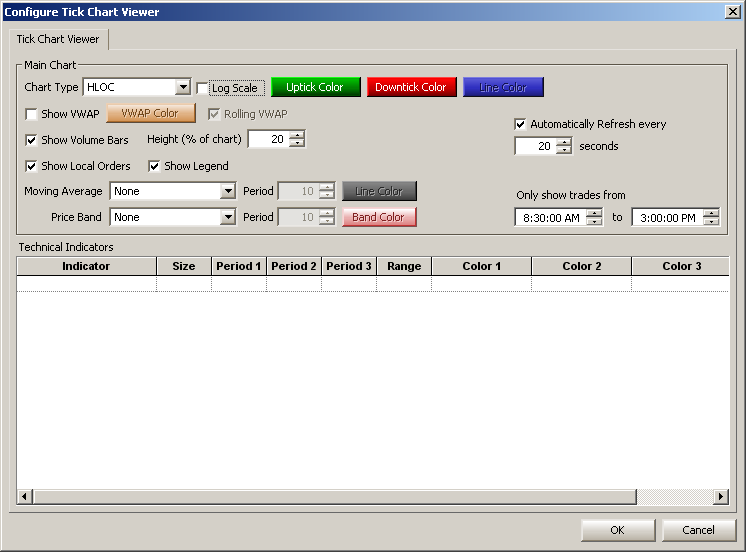

A number of display options are configured through Tick Chart Viewer's configuration window including the chart type, color display, moving average and price band types.

Open the Configuration Window

Press the configuration button

![]() .

.

Alternate Method:

From the Config menu select Configuration.

Different data is displayed depending on the selected chart.

From the drop-down list select the desired chart type:

HLOC (High Low

Open Close)—default (see image at the top of

the page)

Charted data displayed:

Opening, High, Low, and Closing Prices

Local Buy Orders (optional)

Local Sell Orders (optional)

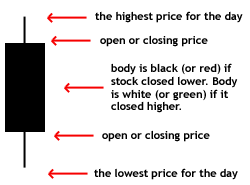

Candle Stick—Charting

that displays the following:

Candle

Stick chart

Charted data displayed: Same as HLOC

Closing Price—a

single line plotted for the closing price of a selected bar size.

Charted data displayed:

Closing Price

Local Buy Orders (optional)

Local Sell Orders (optional)

Median Price—a

single line plotted for the median (i.e., mid-point) price of

a selected bar size.

Charted data displayed:

Median Price

Local Buy Orders (optional)

Local Sell Orders (optional)

Typical Price—a

single line plotted for the typical price (i.e., average price)

of a selected bar size.

Charted data displayed:

Typical Price

Local Buy Orders (optional)

Local Sell Orders (optional)

Weighted Close—a

single line plotted for the weighted close of a selected bar size.

The weighted close is calculated as: (High + Low + Close

x 2) / 4

Charted data displayed:

Weighted Close Price

Local Buy Orders (optional)

Local Sell Orders (optional)

The default display for Tick Chart Viewer is via the linear scale axis.

Check the Log Scale box to have the Chart Viewer display charting data using the logarithmic scale axis.

The Log Scale applies only to the price axis.

The line colors displayed in the chart types can be configured.

For the HLOC and Candle Stick Chart types:

Click on either the Uptick Color box (green by default) or Downtick Color box (red by default) to open a color window where a basic color can be selected or a custom color can be defined.

For Closing Price, Median Price, Typical Price, and Weighted Close Chart types:

Click on the Line Color box to open the color window where a basic line color can be selected or a custom color defined.

Click the Show VWAP (Volume Weighted Average Price) box to display its charted data.

VWAP Color

Click the VWAP Color button to open a color window where a basic VWAP line color can be selected or a custom color defined.

Rolling VWAP

A non-rolling VWAP is the default VWAP setting and generally follows the graph data in whatever chart type has been selected.

A rolling VWAP is calculated as a weighted average of all VWAPs.

Volume Bars display volume data for a selected stock based on the number of shares traded and encompasses the selected date range. The Volume Bars are placed at the bottom of Tick Chart Viewer.

By default, the Show Volume Bars box is checked. To not display Volume Bars, uncheck this box.

Height of Volume Bars

By default the height of the Volume Bars is 20% (or one-fifth) the size of Tick Chart Viewer.

To increase the size of the Volume Bars key in a percentage value (or select a value from the spinner arrows). As a general rule, limit the size of the Volume Bars to 50% of Tick Chart Viewer to allow the Volume Bars and Tick Chart Viewer data to be equally visible.

Show Local Orders refers to executed orders only.

Check the Show Local Orders box to display Local Sell Orders and Local Buy Orders in Tick Chart Viewer.

By default, the legend in Tick Chart Viewer is displayed. Un-check the Show Legend box to hide the legend.

Moving averages display an overall trend direction and are normally calculated using a stock's closing price. Moving averages can also be determined with median, typical, or weighted close prices.

Select a Moving Average Type

From the drop-down list in the Moving Average field, select a moving average type:

Simple—The

average stock price over a certain period of time

Exponential—Similar

to a Simple Moving Average. an exponentially weighted moving average

gives more credence to a most recent time period (i.e., what trades

are doing now).

Triangular—The

triangular moving average gives more weight to the middle values

of moving average data rather

than early or late values.

Weighted—The weighted moving average is the weighted average of the last number of a defined time period.

Select a Moving Average Time Period

Key in a value (or use the up/down spinners) that represent the value of the selected Bar Size in which the Moving Average is calculated. For example, if the Bar Size is set for one day and the Moving Average period is set for 20, then 20 days are plotted.

Define a Moving Average Line Color

Press the Line Color button to open the color window where a basic color or custom color can be defined for the moving average line.

One of three price bands (price range which stocks are priced) can be charted in Tick Chart Viewer.

Select one of the following price bands from the drop-down list:

Bollinger

Bands—Provide a relative analysis in which graph lines

are plotted by two standard deviations above

and below a moving

average.

A market which approaches an upper band is usually thought of as

being overbought while a market approaching the lower band is

thought of as oversold.

Donchian

Channel—Similar to Bollinger Bands, Donchian Channel

performs a calculation using only the recent

high and low prices (rather than standard deviations).

Envelope—Band envelope consists of moving averages calculated from the underlying price that is shifted up and down by a fixed percentage. These averages can be simple, exponential, or weighted.

Select a Price Band Time Period

Key in a value (or use the up/down spinners) that represent the number of days in which the price band is calculated.

Define a Price Band Line Color

Press the Line Color button to open the color window where a basic color or custom color can be defined for the price band line.

Check the Automatically Refresh Every box and enter a value (in seconds) to have Tick Chart Viewer refresh the chart.

If unchecked, Tick Chart Viewer will only refresh when the Refresh button (above the chart) is pressed.

The minimum refresh interval is 10 seconds.

Tick Chart Viewer will show trades only from a specifically defined time period.

Manually key in the start/stop times or use the up/down spinner arrows.

There are a number of technical indicators from which to choose. These indicators are charted in its own graph below Tick Chart Viewer. Depending on the selected indicator, up to three colors are defined. As with all colors in Tick Chart Viewer, they can be customized.

With each indicator are a number of customized fields that are defined. The fields that can be edited (those with up/down spinner arrows) are dependent on the selected technical indicator:

Size—The

height of the indicator chart in pixels.

Period

(1, 2, 3)—The period to compute the indicator.

Range—Defined

by the chart type.

Color (1, 2, 3)—The color(s) used to represent a specific indicator line. Each color can be customized.

Select an indicator from the drop-down list in the Indicator field.

More than one technical indicator can be simultaneously defined. Each defined technical indicator is stacked in its own chart.

Accumulation/Distribution—Determined

by the changes in price and volume. As the indicator grows it

refers the buying of a security. If it drops it indicates the

selling of a security.

Aroon—Used

for defining trends. An Up indicator and a Down indicator are

displayed.

Aroon

Oscillator—The trend stop and start of a sideways trend

and is calculated as the difference between Aroon Up and Aroon

Down.

Average

Directional Index—Determines a price trend (positive,

negative, average).

Average

True Range—An indicator showing the volatility of the

market.

Bollinger

Band Width—Represents the expanding and contracting

of the bands based on market volatility.

Commodity

Channel Index—The deviation of the commodity price

from its average statistical price (defined with an indicator

line, above and below thresholds).

Chaikin

Money Flow—Based on the observation that buying support

is normally signaled by increased volume and frequent closes in

the top half of the daily range. Selling pressure is seen by increased

volume and frequent closes in the lower half of the daily range.

Chaikin

Oscillator—The difference of the moving averages of

the Accumulation/Distribution

indicator.

Chaikin

Volatility—A determination of the volatility of financial

data using the percentage of change in a moving average of the

high vs. low price over a given time.

Period 1: The period to smooth the range.

Period 2: The period to compute the rate of change of the smoothed

range.

Close

Location Value—A measure to determine where the price

of a stock closes relative to the day's high and low. CLV ranges

between +1 and -1 where +1 means the close is equal to the high

and a value of -1 means the close is equal to the day's low.

Detrend

Price Oscillator—Used to isolate short-term cycles

comparing the closing price to a prior moving average.

Donchian

Channel Width—A moving average plotting the highest

high and lowest low for a set period.

Ease

Of Movement—Highlights the relationship between volume

and price changes used primarily for assessing the strength of

a trend.

Fast

Stochastic—Used to track momentum, two lines are used:

%K compares the

latest closing price to the recent trade range, and %D

is a signal line calculated by smoothing %K.

Period 1: The period to compute the %K line.

Period 2: The period to compute the %D line.

MACD—Moving Average

Convergence Divergence. MACD measures

the distance between two moving average lines and used to trade

trends.

Period 1: The first moving average period to compute the indicator.

Period 2: The second moving average period to compute the indicator.

Period 3: The moving average period of the signal line.

Mass

Index—Used in the detection of trend turns based on

changes in the bandwidth between the maximum and minimal price.

If the bandwidth expands, the Mass Index increases. If it narrows,

the Mass Index decreases.

Money

Flow Index—An indicator which shows the rate at which

money is invested into a security and then withdrawn from it.

Range: The distance between the middle line and the upper and lower

threshold lines.

Momentum—A

measurement of the amount that a security's price has changed

over a given time span. It is calculated as a ratio of today's

price to the price of several periods ago.

Moving

Standard Deviation—A measure of market volatility (though

it makes no prediction of market direction).

Negative

Volume Index—An index that focuses on the days where

the volume has significantly decreased from the previous day's

trading.

On

Balance Volume—An indicator that adds a period's volume

when the close is up and subtracts the period's volume when the

close is down. The concept is that volume precedes price.

Performance—The

performance indicator of a selected security.

Percentage

Price Oscillator—A technical momentum indicator showing

the relationship between two moving averages based on price.

Period 1: The first moving average period to compute the indicator.

Period 2: The second moving average period to compute the indicator.

Period 3: The moving average period of the signal line.

Positive

Volume Index—An index that focuses on days where the

volume has significantly increased from the previous day's trading.

Percentage

Volume Oscillator—A technical momentum indicator showing

the relationship between two moving averages based on volume.

Period 1: The first moving average period to compute the indicator.

Period 2: The second moving average period to compute the indicator.

Period 3: The moving average period of the signal line.

Price

Volume Trend—A technical indicator used to determine

the balance between a stock's demand and supply depending upon

its upward and downward movement.

Rate

of Change—The speed at which a variable changes over

a specific time period. The rate of change is represented by the

slope of the line.

Relative

Strength Index—A technical momentum indicator that

compares the magnitude of recent gains to recent losses in an

attempt to determine overbought and oversold conditions of an

asset.

Range: The distance between the middle line and the upper and lower

threshold lines.

Slow

Stochastic—An indicator that compares two lines (%K and %D)

to predict the possibility of an uptrend or a downtrend. The %K value is based on

a 3-period moving average of the %K

fast stochastics value. The %D

value is based on a 3-period moving average of the %K

slow stochastics value.

Period 1: The period to compute the %K line.

Period 2: The period to compute the %D line.

Stochastic

RSI—An indicator that ranges between zero and one and

is deemed to be oversold when the value drops below 0.20 meaning

the RSI (Relative Strength Index) value is trading at the lower

end of its predefined range. It also indicates that the

short-term direction of a security is near to a correction. A

reading above 0.80 is indicative that the RSI is reaching an extreme

level and could signal a pullback of a security.

Range: The distance between the middle line and the upper and lower

threshold lines.

TRIX—Used

in determining of overbought or oversold market conditions. A

positive value indicates and overbought market. A negative value

indicates an oversold market.

Ultimate

Oscillator—Combines a stock's price action during three

different time frames. Values range from 0 to 100 with 50 as the

center line. An oversold stock exists below 30 and an overbought

stock extends from 70 to 100.

Period 1: The first moving average period to compute the indicator.

Period 2: The second moving average period to compute the indicator.

Period 3: The third moving average period to compute the indicator.

Range: The distance between the middle line and the upper and lower

threshold lines.

Volume

Indicator—Displays in the same manner as the volume

indicator in Tick Chart Viewer.

William

%R—A momentum indicator that displays the relationship

of the close relative to the high/low range over a defined period

of time (usually 14 days).

Range: The distance between the middle line and the upper and lower

threshold lines.

The value of each plotted point along Tick Chart Viewer's x/y axis is viewed by positioning the mouse over the graph's line.

Local orders are displayed in the chart. They are designated by a square in one of various colors depending on their status. The legend at the top of Tick Chart Viewer defines the various states of an order.

Changed orders are marked with a circle. For non-limit orders that have been changed, the order's average price is displayed.

Canceled orders that have been partially filled are marked with an X. Canceled orders with a zero filled quantity will not be displayed.

For volume data, position the mouse over each bar in the graph for a detailed readout.

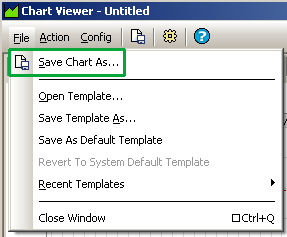

Configuration settings for Tick Chart Viewer can be saved in a template. The file will have a .hloct extension.

Also, a desired chart can be saved as a default. Template commands are found in the File menu.

Read more about templates here.

The Save Chart As feature allows you to save a chart as an image file in one of the following formats:

bmp

png

jpg

gif

Save a Chart as an Image File:

From the File column in Tick Chart Viewer, select Save Chart As...

Alternate

Method:

Right-click anywhere on the chart

itself. Select File Commands-->Save

Chart As...

When the Save As window opens, select a file name, file type, and destination for the chart image.

Open Other WTP Applets from Tick Chart Viewer

Other WTP applets such as the Option Quote Cube via the send to command in the Action menu in Tick Chart Viewer.

The only thing that is actually sent to these applets is the security name currently displayed in Tick Chart Viewer.

Create and Cancel Orders from Tick Chart Viewer

Press Ctrl+n to open the Order Ticket.

Alternate Method:

From the Action menu select New Order.

Press Ctrl+z to cancel all orders for a specific symbol.

Alternate Method:

From the Action menu select Cancel All for Symbol xxx.

Cancel All Orders

From the Action menu select Cancel All Orders.

Launch Equity Time and Sales from Tick Chart Viewer

The Toggle Symbol Tracking function is available in Tick Chart Viewer.

When enabled the symbol in Tick Chart Viewer will change depending on the symbol selected in other WTP applets.

Learn about Toggle Symbol Tracking here.

The status bar displays the current time and ready status of Tick Chart Viewer.

From the Config menu select Status Bar to enable/disable it.

© 2015 Wolverine Execution Services, LLC